London: Wall Street approaches the UK markets with its race to establish the lowest stock brokerage fees. On Monday, A.J. Bell, a British digital stockbroker, stated that it intends to publish a recently developed app offering zero commission investments at the beginning of 2022.

This shift will witness A.J. Bell contend with a stream of fintech facilitating parallel services, comprising Freetrade, eToro, and Revolut. It might also mount pressure on competing companies such as Interactive Investor and Hargreaves Lansdown to adopt the pattern.

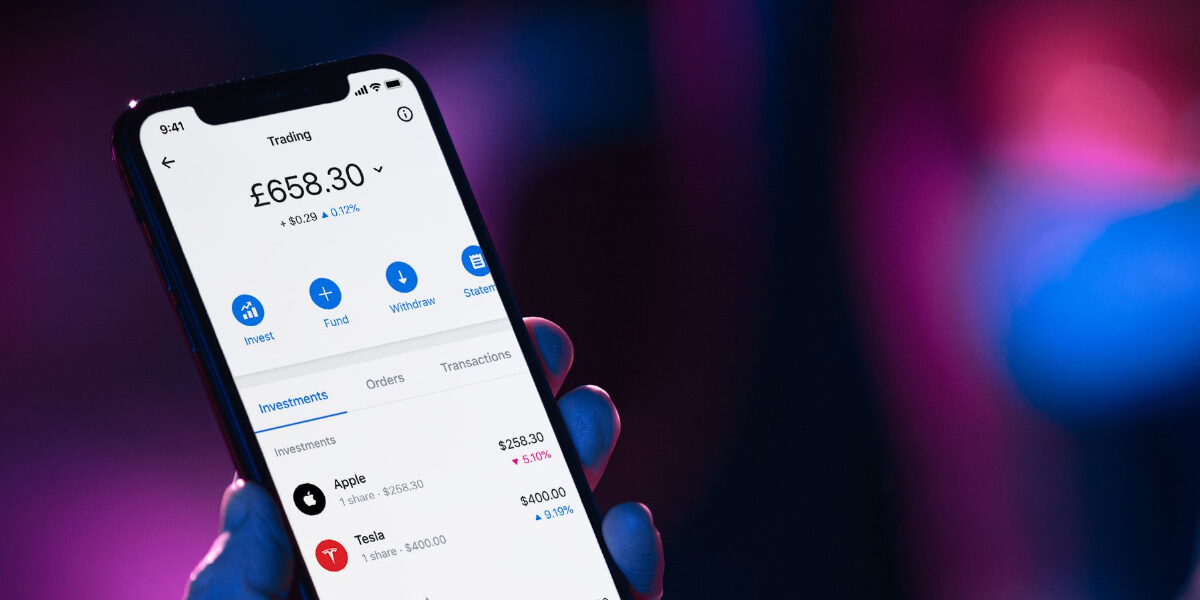

Dodl, A.J. Bell’s application enables buyers and sellers access to a spectrum of notable listed stocks in the UK. Although the US shares aren’t available at the opening phase; however, the firm stated that it intends to bring them in as soon as the app launches.

Additionally, the firm will extend multi-asset funds along with six distinct levels of risk and a scale of themed funds concentrating on segments such as health care, tech, and responsible investing.

Users will get options to create a saving account for individuals, a general account for investment, and a lifetime ISA. Moreover, users will be ushered with investment advice by the “friendly monsters,” easing the decision-making.

Dodl plans to charge a yearly fee that will be 0.15% of a portfolio’s worth; however, it also plans to skip tax wrapper charges or commission fees. As a result, customers investing and buying funds will also owe money to cover the fund’s annual costs.

Andy Bell, Chief Executive to A.J. Bell, stated, “Dodl launched by A.J. Bell is ideal for anyone seeking an affordable and user-oriented investment application, aiding the users in catching up with their investment objectives; like creating reserves; for holidays, retirement, or a house.”

“The instinctive investment venture and modernized investment group will please especially those who have never invested and need an effortless method to handle investments.”

In the middle of an extensive European equity market rally, A.J. Bell’s shares sped up beyond 1% on Monday.

A.J. Bell’s strike within the no commission trading zone appears in correspondence to a swamp of fintech players in the wealth management universe that has made it painless for regular investors to get their hands on the stock market.

Robinhood, a Silicon Valley firm, led the movement in the U.S. However, the rising fame of the investing platform had many other brokerage companies follow their footstep in adjusting and sinking their leviable commissions to zero.

Plenty of digital trading companies in the U.K. have surfaced, rendering users economic means of stock trading and characteristics focused on enhancing financial knowledge and awareness, including eToro, Freetrade, and Revolut.

Although applications such as Robinhood assisted in opening up the investing journey to the public, few specialists worry that people are managing trades as though it were a game.

Robinhood spotted itself in the middle of a ferocious trading mania ahead of this year, which resulted in new and inexperienced investors kicking up the stock pricing of firms such as AMC, GameStop, and others, taking motivation from Reddit’s renowned community.